In this blog we will explore how to navigate impact investment. To do so we will first, clarify what impact means in a business context, second, we will define what impact investment implies, third, we will look at the state of the market, and finally, we will answer why you too could take part in impact investing.

In the meantime, to learn more about impact investment and start your own journey within this thriving market, you can register for our tech4SDGs DAY coming up on the 2nd of March.

Impact in context

Whilst impact comes in different shapes and forms, Impact VC and Impact Management Project remind us that;

Impact VC, 2023.

“Impact is a change in an outcome caused by an organization. An impact can be positive or negative, intended or unintended. An outcome is the level of well-being experienced by a group of people, or the condition of the natural environment, as a result of an event or action.”

In a business context, the word impact can take place at one or multiple levels, Impact VC reports three known levels. First, in the business’ model, through selling products/services that benefit the environment. Second, impact can manifest through a business’ operations. For example, the way an organization will market themselves can have a social and environmental impact. Finally, businesses can generate impact through their profit. For example through philanthropy, or cross-subsidizing models.

Impact investment, what is it?

A few definitions exist but we agree on the one brought forward by Impact VC and the Global Impact Investing Network (GIIN). They both tell us that Impact investments are usually investments made by fund managers, banks, and foundations, to cite just a few, and have the objective to generate positive measurable social and environmental impacts, at the same time as generating financial returns. This type of investment can target a range of different returns depending on strategic goals.

The state of the market

Impact investing represents a market that is fast growing. Through its impact, it aims to address the world’s most pressing problems in a plethora of different sectors that demand growing attention such as renewable energies, financial inclusivity, and sustainable agriculture, as well as, housing, education, health and so on.

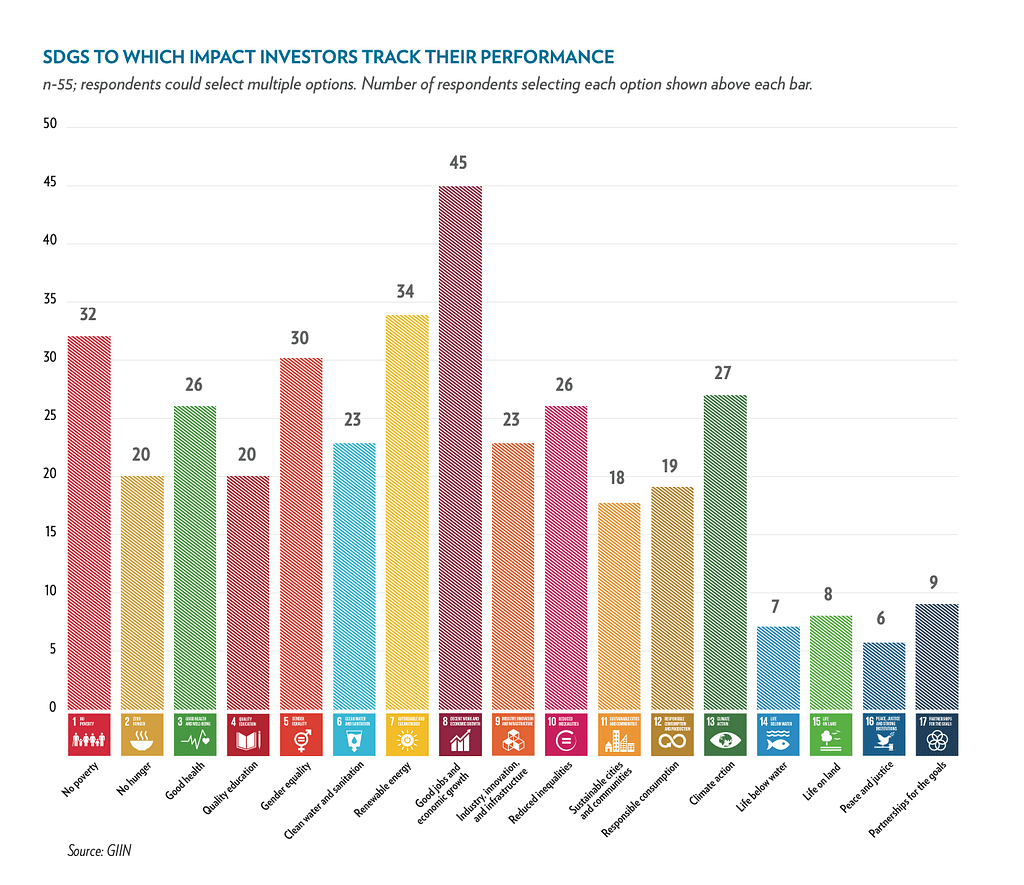

Impact investment has taken a new turn since the creation of the sustainable development goals (SDG) by the United Nations in 2015. Those SDGs focus on 17 goals that can drive social and environmental change. It is worth noting here that these have been developed in collaboration with the private sector’s input. As well as providing a useful barometer for the UN to measure worldwide progress towards and fairer world SDGs provide an efficient framework for organizations to measure their own impact on the planet and the people inhabiting it.

You can see below a chart showing which SDG investors have been impacted. This same chart can help investors understand, adjust, and predict their impact to better attend to SDGs

In 2022 the GIIN estimated that 3349 organizations managed over $1.164 trillion in impact investment. Furthermore, GIIN tells us that green bonds i.e., financial instruments used by public and private institutions to fund sustainable projects, have increased by 43% in 2021 and reached a total of $1 trillion.

Despite the promising above numbers, efforts to accelerate the impact investment market are relatively recent and investors are optimistic regarding its growth and expect even more scaling and efficiency as the market matures.

Why take part in impact investing

One key aspect for any investor ready to start their impact investment journey is the understanding that investing has the potential to redefine the role of capital in societies. Since its important growth, impact investment has demonstrated time and time again its potential to drive progress on both social and environmental levels.

Impact investment can be seen as challenging the commonly held belief that social and environmental issues are to be addressed by governmental bodies or philanthropic enterprises allowing in turn for private companies to start investing in better futures and move away from the idea that market investments are solely destined to financial returns.

At tech2impact, supporting investors in their journey towards impact investment, is what we do. As a member of our community you could discover impact tech investment deals that are suited for you. If that sounds like something you, or your organization, would benefit from, at tech2impact we are waiting for you. Click bellow and join our thriving community of impact driven investors.

Want to learn more?

You can register now for our upcoming tech4SDGs DAY to learn more about impact investment and how YOU and your organization can make a positive impact.